Thank You For Your Patience

We’ve completed our system upgrade, and we want to sincerely thank you for your patience, kindness, and support through this big transition. Your encouragement has meant the world to our team.

We know change hasn’t been without its challenges, but we’re making steady progress every day. Our goal is to deliver a more modern, secure, and reliable system that will serve our members well into the future.

Why we made the change:

Our previous system was outdated and sunsetting. This new platform gives us modern, efficient, and secure tools that will allow us to serve you better- faster processing, stronger integration, and more flexibility for future improvements.

We’re excited about what’s ahead- and we’re so glad you’re here for it.

Quick Update: Known Issues & Status

Here’s what we’re currently aware of and working on. We’ll update this section regularly.

| Issue | Status | Last Updated |

|---|---|---|

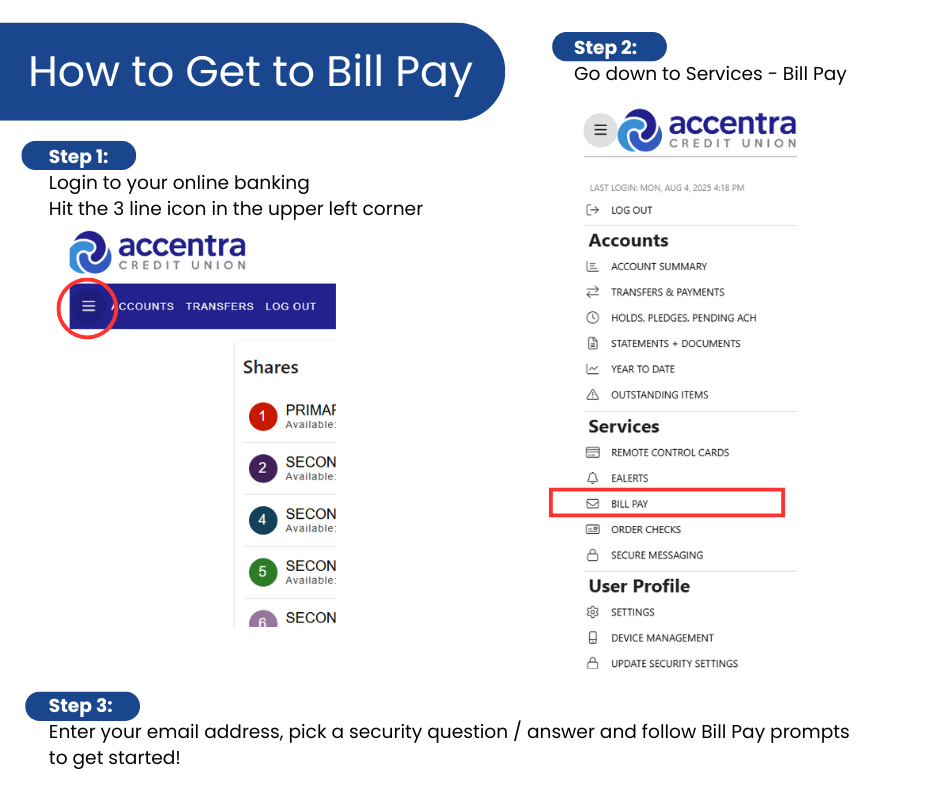

| Bill Pay access | Live and available | August 4, 2025 |

| Android App | Live and available | August 29, 2025 |

| Apple App | Live and available | August 4, 2025 |

| Temporary code emails | Still not receiving it? We may need to update your email in our system and verify account number. Call, email us at [email protected], or visit us. | August 7, 2025 |

| High call volume | Long wait times on phones due to high call volume | August 18, 2025 |

| Debit Cards | Card activation issues resolved. If you're experiencing card issues please call us. | August 12, 2025 |

| Accentra VISA Credit Card History |

'Third Party Loan', not displaying history. Needs integration. Call us for transaction history information. |

August 6, 2025 |

| Check Ordering | Live and available. | September 22, 2025 |

| Quicken Integration | Live and available. | September 3, 2025 |

| ATM Fees | Some members receiving ATM fees in error. We're working on reversing these as quickly as possible. | August 14, 2025 |

| Third-party app connections (e.g., Rocket Money) |

Some third-party apps may not connect properly after the system upgrade. To resolve this, log in to the third party’s website (e.g., Rocket Money), delete the existing Accentra connection, and re-add it using your updated online banking credentials. Once reconnected, your Accentra info should sync properly in the app. | September 10, 2025 |

New! E-Receipts Now Sending

Members will now begin receiving e-receipts via email for certain transactions!

Please note: These e-receipts are still a bit messy in format as we work out the kinks. We’re actively working to clean them up for a better experience. For now, we just wanted to give you a heads-up that these emails are legitimate and being sent automatically after select transactions.

Tutorials

Check out these video walkthroughs:

How-to: Getting Logged into Our New System

Apple Users:

The new 'Accentra Credit Union Mobile' App is now available! If you previously had our app, it will automatically be updated. If you've never had our app, you can download it in the App Store to get started.

Android Users:

Our new app is not yet live in the Google Play Store. But don’t worry—you can still log in using your phone’s browser:

- Go to www.accentracu.org

- Tap the Login button in the top-right corner

First-Time Login Instructions

Whether you're logging in on desktop or mobile (Apple or Android browser), here’s how to get started:

Please note: You will need access to your email as you will receive 3 separate emails containing codes and a temporary password.

-

Visit www.accentracu.org and tap Login (top right).

-

Username: Use your 6-digit member/account number (found on your statement or laminated card).

-

Click Forgot Password. Enter your 6-digit account number in the username field again. Hit Submit.

-

Check your email for a login code.

-

Return to the login screen and enter the code.

-

Go back to your email. You’ll receive a new email containing a temporary password. Copy that temporary password or write it down (it is case sensitive).

-

Return to login screen. Log in using your 6-digit account number as the username and enter that temporary password.

-

Set up two-factor authentication (you’ll get a code via text or email).

-

Create your new password. It needs to meet the new requirements. You can change your username later in your profile settings.

Having trouble receiving your codes?

Give us a call or email [email protected] and we’ll verify the email address we have on file.

New System Questions?

If you have questions, reach out to us at 1-800-533-0448 (may experience a longer wait time), email [email protected] or stop by your local branch—we’re happy to help!

Together, we’re building a better banking experience for you and our community. Thank you for being part of this exciting change!