Your loan helped make your dreams come true.

Now, protect what you’ve worked so hard for with loan protection.

Benefits You’ll Love

- Cover you loan balance in case of death or unemployment

- Multiple packages available to meet your needs

- Basic eligibility requirements

- Fee bundled into your loan payment for seamless protection

Protect what matters. Life is unpredictable.

- There are a wide range of unexpected events that could leave you and your family scrambling to pay monthly bills. That’s why it’s important you take action to safeguard your family against these types of events to ensure loan payments can be made on time. That’s where Member Protect comes in.

- Under the Member Protect program, your loan balance may be canceled or your monthly loan payments canceled without penalty or added interest. You benefit from the peace of mind knowing you and your credit rating are protected – and most importantly – that your family is protected.

Designed with you in mind.

- More than ever, we all worry about things that might happen tomorrow. Member Protect provides an important sense of financial security – knowing your loan will not become a burden to you in times of hardship.

Cancel at any time.

- You may cancel Member Protect at any time. If you do so within the first 30 days, we will refund any fees already paid.

Availability and plan options:

| Availabe Coverage | Cost | ||||

|---|---|---|---|---|---|

| Death | Disability | Involuntary Unemployement | Rate per $1,000 of monthly loan balance | ||

| Single | Joint | ||||

| Short Term Loans | |||||

| Elite Protect | X | X | X | $3.26 | $5.91 |

| Premier Protect | X | X | $2.43 | $4.33 | |

| Select Protect | X | $0.97 | $1.55 | ||

| Secure Protect | X | $1.46 | $2.78 | ||

| Long Term Loans | |||||

| Elite Protect | X | X | X | $2.22 | $3.83 |

| Premier Protect | X | X | $1.85 | $3.14 | |

| Select Protect | X | $1.20 | $1.91 | ||

| Secure Protect | X | $0.65 |

$1.23 |

||

Member Protect is available for Short Term Loans: closed-end consumer and home equity loans if the loan as a term of 120 months or less; and consumer lines of credit. Long Term Loans: closed-end consumer and home equity loans (e.g. second mortgages) if the loan has a term of more than 120 months; and home equity lines of credit.

- Want to learn more?

- Talk to a representative today by calling 800-533-0448. Visit www.accentracu.org to learn the details about our Member Protect program.

Disclosures

This product is optional

Your purchase of debt protection is optional. Whether or not your purchase this product will not affect your application for credit or the terms of any existing credit agreement you have with us.

Additional disclosures

We will give you additional information before you are required to pay for debt protection. This information will include a copy of the contract containing the terms and conditions of debt protection.

Eligibility requirements, conditions, and exclusions

There are eligibility requirements, conditions and exclusions that could prevent you from receiving debt protection benefits. You should carefully read your debt protection contract for a full explanation of the terms and conditions of the debt protection program.

Protect the investment you’ve made in your vehicle with Mechanical Breakdown Protection (MBP). MBP covers the costs of repairs to the mechanical parts of your vehicle that break down and are not related to events, like an accident, that would be covered by a traditional auto insurance policy. MBP can be applied to new or used vehicles and provides peace of mind that your vehicle will always be road-ready.

Mechanical Breakdown Protection from Accentra includes:

- Competitively priced coverage for new and used vehicles with low or no deductible

- Cost can be financed into your loan payment

- Repairs authorized at any licensed facility in the US and Canada

- Claims paid directly to the repair facility

- Total loss refund that will pay back the original premium

- Additional benefits include 24-hour emergency roadside assistance, towing reimbursement, lock out service, rental car assistance, and much more

- Coverage may be cancelled at any time for any reason

If your vehicle is stolen, accidentally damaged beyond repair, or otherwise declared a total loss, you will be required to pay the difference, or cover the "gap", between your insurance settlement and the remaining balance on your loan. GAP Insurance is designed to cover that expense.

{beginAccordion}

GAP Insurance

GAP keeps you in the driver’s seat

Congratulations! You’re about to buy a vehicle. That is a big investment. How will you protect your asset, if something happens down the road?

- Purchasing a vehicle?

- Protect your investment with GAP Advantage

- Guaranteed Asset Protection (GAP) Advantage

- Is a voluntary, non-insurance program that works with your standard car insurance. It protects the “gap” between the vehicle’s value and the amount you still owe on your loan if your vehicle is stolen or totaled.

- Protect your wallet

- Once you drive off the lot, your vehicle is already worth less. Since most insurance companies base their claim payments on the current value of your vehicle, your loan or lease could be higher than the value of your vehicle in the event of a total loss. Which means you could owe out-of-pocket money to pay off your loan.

- GAP Advantage’s key benefits

- Whether you’re buying a new or used vehicles, GAP Advantage can help relieve your worries – and the financial impact on your wallet – if the unexpected happens.

- That’s because it waives the difference between your primary insurance company’s settlement – and the payoff of your loan blance, up to a certain loan to value maximum (LTV) and subject to limitations and conditions. 1

- The LTV compares the total amound originally financed to the vehicle’s value at ths start of the loan. Included in this waiver is tyour insurance deductible, up to $1,000. 2

- Plus: GAP Advantage gives you a credit up to $1,000 toward the financing or lease of a replacement vehicle – at the original financial institution and within a certain timeframe.

- Please consult with your financing representative regarding application of the LTV limitation to your specific circumstances.

Vehicles GAP covers:

- Automobiles

- Vans

- Light Trucks

- ATVs

- Motorcycles

- Jet skis

- Snowmobiles

- Boats

- Travel Trailers

- Motorhomes

Loan Protection Services - Route 66 Warranty

- Avoid Costly Repairs

- Be ready for the unexpected and ensure you’re covered in the event a mechanical breakdown occurs. With Mechanical Breakdown Protection from Route 66 Warranty, you can rest easy knowing you are covered.

- Route 66 Warranty’s Mechanical Breakdown Protection Plans are available for both new and pre-owned vehicles, and coverage is transferable if you sell your vehicle before your agreement expires added resale value.

- Inclusive benefits

- Zero deductible

- Nationwide coverage

- 24/7/365 Emergency Roadside Service

- 30 Day Money-Back Guarantee

- Transferrable

- Trip Interruption

- Direct Claim Payments via Visa/Mastercard

- Total Loss Refund

- If your car is declared a total loss by the insurance company due to collision or act of God, we will refund the entire original premium of your service agreement.

- All Plans come with Rental Car Allowance and 24 hour/7 days a week Emergency Roadside Service for when the unexpected happens:

- Towing

- Lock-out Service

- Batter Jump Starting

- Flat Tire Assistance

- Minor Adjustments

- About Route 66

- Route 66 Warranty has a complete line of coverage designed to keep your vehicle on the road. Even the most reliable vehicle can develop a mechanical problem. That’s why so many people depend on Route 66 Warranty. No matter where you travel in the Unites States, we protect you against major mechanical expenses, and there is NO DEDUCTIBLE on covered parts or labor.

- It’s That Simple

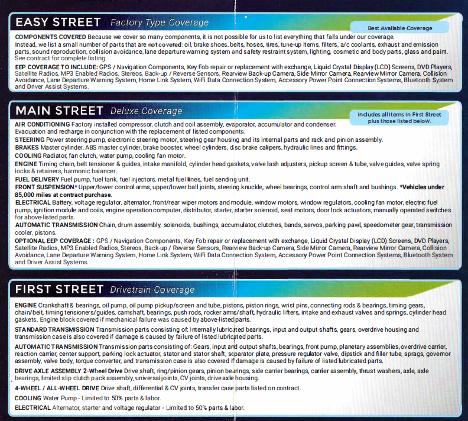

Coverage types:

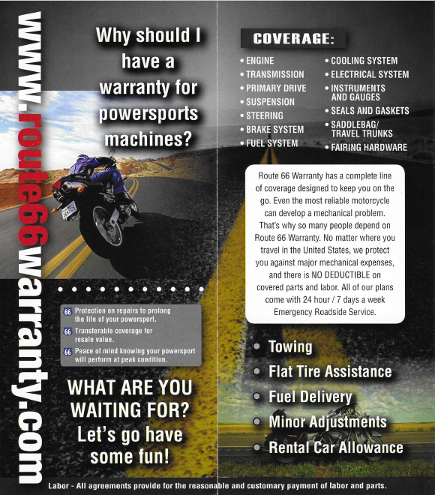

Loan Protection Services – Route 66 PowerSports Warranty

Route 66 Warranty has a complete line of coverage designed to keep you on the go. Even the most reliable motorcycle can develop a mechanical problem. That's why so many people depend on Route 66 Warranty. No matter where you travel in the United States, we protect you against major mechanical expenses, and there is NO DEDUCTIBLE on covered parts and labor. All of our plans come with 24 hour/ 7 days a week Emergency Roadside Service.

{endAccordion}

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term CD can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Balloon Loans

| Term Rates | Rate | APR* as low as |

|---|---|---|

| 5 Year Balloon | 4.750% | 5.014% |

| 7 Year Balloon | 4.875% |

5.140% |

| 10 Year Balloon | 5.125% | 5.506% |

*APR = Annual Percentage Rate. On approved credit. Not all will qualify for the lowest rate. Balloon Loan repayment terms and an amortization schedule.

Boats, RVs, Campers

| Age of Vehicle | 0-2 years | 3-5 years | 6-10 years | 10+ years |

|---|---|---|---|---|

| Term Rates | APR* as low as |

APR* as low as |

APR* as low as |

APR* as low as |

| 12 Months | 6.88% | 7.63% | 8.13% | 8.38% |

| 24 Months | 6.70% | 7.45% | 7.95% | 8.20% |

| 36 Months | 6.64% | 7.39% | 7.89% | 8.14% |

| 48 Months | 6.60% | 7.35% | 7.85% | 8.10% |

| 60 Months | 6.68% | 7.43% | 7.94% | 8.19% |

| 72 Months | 6.82% | 7.57% | 8.07% | 8.32% |

| 84 Months | 6.96% | 7.71% | 8.21% | 8.46% |

| 120 Months | 7.55% | 8.30% | 8.80% | 9.05% |

| 144 Months | 7.54% | 8.29% | 8.79% | 9.04% |

| 180 Months | 8.02% | 8.77% | 9.27% | N/A |

*APR = Annual Percentage Rate. Actual rate will be based on individual’s credit rating, amount financed, and other factors. On approved credit. Not all will qualify for the lowest rate. Rates are subject to change. APR based on loan amount of $25,000 for term and rate chosen. Other dollar amounts available. Payment example: A 60 month $25,000 fixed rate secured new boat/camper/RV loan at 6.68% APR* has an approximate monthly payment of $491.31.

Business Checking and Money Market Savings Interest Rates

| Dividend Rate | APY* | Interest Compounded | Balance |

|---|---|---|---|

| 0.05% | 0.05% | Monthly | $0 - $9,999 |

| 0.10% | 0.10% | Monthly | $10,000 - $24,999 |

| 0.15% | 0.15% | Monthly | $25,000 - $49,999 |

| 0.20% | 0.20% | Monthly | $50,000 - $99,999 |

| 0.35% | 0.35% | Monthly | $100,000 - $249,999 |

| 0.50% | 0.50% | Monthly | $250,000 - Greater |

*APY = Annual Percentage Yield.

Cars, Trucks, and Vans

| Age of Vehicle | 0-2 years | 3-5 years | 6-10 years | 10+ years |

|---|---|---|---|---|

| Term Rates | APR* as low as |

APR* as low as |

APR* as low as |

APR* as low as |

| 12 Months | 5.36% | 5.61% | 6.11% | 6.87% |

| 24 Months | 5.19% | 5.44% | 5.94% | 6.69% |

| 36 Months | 5.12% | 5.37% | 5.87% | 6.63% |

| 48 Months | 5.20% | 5.45% | 5.95% | 6.70% |

| 60 Months | 5.33% | 5.58% | 6.08% | 6.83% |

| 72 Months | 5.32% | 5.57% | 6.07% | 6.82% |

| 84 Months | 5.45% | n/a | n/a | n/a |

* APR = Annual Percentage Rate. Actual rate will be based on individual’s credit rating, amount financed, and other factors. On approved credit. Not all will qualify for the lowest rate. Rates are subject to change. APR based on loan amount of $25,000 for term and rate chosen. Other dollar amounts available. Payment Example: A 60 month $25,000 fixed rate secured new auto loan at 5.33% APR* has an approximate monthly payment of $475.00.

Certificate Accounts

| Term | Rate | APY* | Interest Compounded | Minimum Opening Deposit |

| 3 Months | 0.20% | 0.20% | At Maturity | $500.00 |

| 6 Months | 0.25% | 0.25% | At Maturity | $500.00 |

| 6 Months Special*** | 3.50% | 3.53% | At Maturity | $500.00 |

| 18 Months** | 2.66% | 2.69% | Monthly | $10.00 |

| 24 Months | 0.40% | 0.40% | Quarterly | $500.00 |

| 36 Months | 0.50% | 0.50% | Quarterly | $500.00 |

| 48 Months | 0.60% | 0.60% | Quarterly | $500.00 |

| 60 Months | 0.70% | 0.70% | Quarterly | $500.00 |

*APY = Annual Percentage Yield

**Applies to 18 month term only: the interest rate and Annual Percentage Yield (APY) are variable and is based on an Index. 18 month certificate is not available to Business Accounts.

*** Applies to 6 month special certificate only: At maturity, the 6-month special certificate will automatically renew at the standard 6-month certificate's rate and term.

Christmas Club

| Dividend Rate | APY* | Interest Compounded | Minimum Opening Deposit |

|---|---|---|---|

| 0.10% | 0.10% | Quarterly | $20.00 |

*APY = Annual Percentage Yield. Dividends are calculated on an average daily balance, and are compounded and credited quarterly. Dividend rates and APY's may change monthly after the account is opened, based on market conditions. Withdrawals and service charges or fees may reduce earnings.

Construction Loans

| Term Rates | Rate | APR* as low as |

|---|---|---|

| Up to 1 Year | 4.750% | 5.014% |

*APR = Annual Percentage Rate. On approved credit. Not all will qualify for the lowest rate. During the construction phase, payments are interest only based on the loan amount advanced.

Home Equity - Line of Credit

| Term Rates | APR* as low as |

|---|---|

| Introductory Rate for 6 months | 3.90% |

| Rate after 6 months | 6.750% |

*APR = Annual Percentage Rate. On approved credit. Not all will qualify for the lowest rate. Payments: 1.0% of principal balance owed on the monthly billing date (minimum payment $50) after each new advance. Loan term is 20 years - 10 year draw period and 10 repayment period. Rate subject to change semi-annually. Maximum rate 18%. A 20 year $30,000 variable rate home equity loan at 6.750% APR has an approximate monthly payment of $300. Other terms and amounts are available.

Home Equity Loans

| Term Rates | Rate | APR* as low as |

|---|---|---|

| 5 Year Fixed Rate, Up to 80% of Value | 4.875% | 5.162% |

| 10 Year Fixed Rate, Up to 80% of Value | 5.875% | 6.029% |

*APR = Annual Percentage Rate. On approved credit. Not all will qualify for the lowest rate. Payment example: A 5 year $15,000 fixed rate home equity loan at 5.162% APR has an approximate monthly payment of $282.21. Other terms and amounts are available.

Home Improvement Loans

| Loan Amount | APR* as low as |

|---|---|

| Up to $10,000 | 6.00% |

*APR = Annual Percentage Rate. Actual rate will be based on individual’s credit rating, amount financed, and other factors. On approved credit. Not all will qualify for the lowest rate. Rates are subject to change. APR = Annual Percentage Rate is based on a $100,000 mortgage with a 1% origination fee and a 20% down payment.

Home Loans

| Term Rates | Rate | APR* as low as |

|---|---|---|

| 10 Year Fixed | 5.125% | 5.506% |

| 15 Year Fixed | 5.375% | 5.734% |

| 20 Year Fixed | 5.375% | 5.659% |

| 30 Year Fixed | 5.750% | 5.965% |

*APR = Annual Percentage Rate. On approved credit. Not all will qualify for the lowest rate. Fixed rate repayment terms and an amortization schedule.

IRA Savings

| Dividend Rate | APY* | Interest Compounded | Minimum Opening Deposit |

|---|---|---|---|

| 0.10% | 0.10% | Quarterly | $20.00 |

*APY = Annual Percentage Yield. Dividends are calculated on an average daily balance, and are compounded and credited quarterly. Dividend rates and APY's may change monthly after the account is opened, based on market conditions. Withdrawals and service charges or fees may reduce earnings.

Kasasa Cash*

| Balance | Minimum Opening Deposit | Rate | APY |

|---|---|---|---|

| 0 - $15,000 | $x | 0.00% | 0.00% |

| $15,000+ | $x | 0.00% | 0.00% |

| All balances if qualifications not met | $x | 0.00% | 0.00% |

Qualifications

xx

Kasasa Saver*

| Balance | Minimum Opening Deposit | Rate | APY |

|---|---|---|---|

| 0 - $15,000 | $x | 0.00% | 0.00% |

| $15,000+ | $x | 0.00% | 0.00% |

| All balances if qualifications not met | $x | 0.00% | 0.00% |

Qualifications

xx

Money Market Savings

| Dividend Rate | APY* | Interest Compounded | Balance |

|---|---|---|---|

| 0.05% | 0.05% | Monthly | $0 - 2,499 |

| 0.05% | 0.05% | Monthly | $2,500 - 9,999 |

| 0.10% | 0.10% | Monthly | $10,000 - 24,999 |

| 0.15% | 0.15% | Monthly | $25,000 - 49,999 |

| 0.20% | 0.20% | Monthly | $50,000 - 99,999 |

| 0.35% | 0.35% | Monthly | $100,000 - Greater |

*APY = Annual Percentage Yield. Dividends are calculated on an average daily balance, and are compounded and credited quarterly. Dividend rates and APY's may change monthly after the account is opened, based on market conditions. Withdrawals and service charges or fees may reduce earnings.

Motorcycles, ATVs, Snowmobiles, and Jetskis

| Age of Vehicle | 0-2 years | 3-4 years | 5-7 years | 8+ years |

|---|---|---|---|---|

| Term Rates | APR* as low as |

APR* as low as |

APR* as low as |

APR* as low as |

| 12 Months | 7.27% | 7.67% | 8.02% | 8.52% |

| 24 Months | 7.09% | 7.49% | 7.84% | 8.34% |

| 36 Months | 7.13% | 7.53% | 7.88% | 8.38% |

| 48 Months | 7.34% | 7.74% | 8.09% | 8.59% |

| 60 Months | 7.57% | 7.98% | 8.33% | 8.83% |

| 72 Months | 7.81% | 8.21% | 8.56% | 9.06% |

*APR = Annual Percentage Rate. Actual rate will be based on individual’s credit rating, amount financed, and other factors. On approved credit. Not all will qualify for the lowest rate. Rates are subject to change. APR based on loan amount of $25,000 for term and rate chosen. Other dollar amounts available. Payment Example: A 60 month $25,000 fixed rate secured new PowerSport loan at 7.57% APR* has an approximate monthly payment of $501.83.

Other Secured Loans

| Age of Vehicle | 0-2 years | 3-4 years | 5-7 years | 8+ years |

|---|---|---|---|---|

| Term Rates | APR* as low as |

APR* as low as |

APR* as low as |

APR* as low as |

| 12 Months | 7.28% | 8.03% | 8.53% | 8.78% |

| 24 Months | 7.10% | 7.85% | 8.35% | 8.60% |

| 36 Months | 7.04% | 7.79% | 8.29% | 8.54% |

| 48 Months | 7.05% | 7.80% | 8.30% | 8.55% |

| 60 Months | 7.07% | 7.82% | 8.33% | 8.58% |

| 72 Months | 7.46% | 8.21% | 8.71% | 8.96% |

| 84 Months | 7.55% | 8.30% | 8.80% | 9.05% |

| 120 Months | 8.04% | 8.79% | N/A | N/A |

*APR = Annual Percentage Rate. Actual rate will be based on individual’s credit rating, amount financed, and other factors. On approved credit. Not all will qualify for the lowest rate. Rates are subject to change. APR based on loan amount of $25,000 for term and rate chosen. Other dollar amounts available. Payment Example: A 60 month $25,000 fixed rate new other secured loan at 7.07% APR* has an approximate monthly payment of $495.90.

Share Savings

| Dividend Rate | APY* | Interest Compounded | Minimum Opening Deposit |

|---|---|---|---|

| 0.05% | 0.05% | Quarterly | $5.00 |

*APY = Annual Percentage Yield. Dividends are calculated on an average daily balance, and are compounded and credited quarterly. Dividend rates and APY's may change monthly after the account is opened, based on market conditions. Withdrawals and service charges or fees may reduce earnings.